Bridge Loans

Bridging The Gap to Business Success!

Seize New Opportunities with ROGP Capital’s Bridge Loan – Fast Funding to Keep Your

Business Growing!

As the economy rebounds, businesses are seeing new opportunities—but many banks are still slow to lend. If you're experiencing strong growth but struggling to secure traditional financing, ROGP Capital and our trusted lending partners have the perfect solution: Bridge Financing.

✨ Access up to $1,000,000 in funding—without the long bank wait times.

✨ Flexible repayment terms up to 36 months to support your growth

✨ Secure capital now while working on SBA or traditional bank loans

✨ Move forward with expansion, new investments, and high-return projects

✨ Quick approvals—no long bank delays

✨ Keep your business moving while securing long-term financing

A Bridge Loan is designed to fuel business expansion, investment opportunities, and growth projects without disrupting your cash flow. Instead of waiting on slow-moving bank approvals, get the funding you need NOW and take your business to the next level.

📞 Book a call today to secure your Bridge Loan and start growing with confidence!

📞 Apply today!

What is a Bridge Loan?

A Bridge Loan is a short-term financing solution designed to help businesses seize growth opportunities and high-return investments without disrupting cash flow. Many small businesses and startups encounter game-changing opportunities but lack the immediate capital to act. Entrepreneurs often face the challenge of managing daily expenses while funding expansion efforts, making it difficult to bring innovative ideas to life.

With a Bridge Loan from ROGP Capital, you get quick access to funding, allowing you to take advantage of new opportunities, scale your business, and increase profitability—without financial strain.

📞 Call us today and unlock new possibilities for your business!

Size Matters!

Bigger Loans, Longer Terms, Greater Rewards

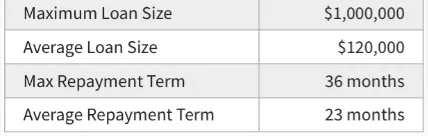

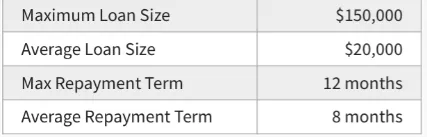

Big ideas deserve big funding—something a typical merchant cash advance just can’t deliver. If you’re ready to level up this year, we offer financing designed to fuel your most ambitious projects. Borrow up to $1,000,000 with flexible terms up to 36 months, keeping costs low and growth high. On average, our loan sizes are six times larger and our repayment terms are three times longer than a standard merchant cash advance. That means you get the capital you need to seize real growth opportunities, while longer terms ensure low, manageable payments that protect your cash flow. See how we stack up below:

Average ROGP Capital

Business Loans

Merchant Cash Advance

Minimum Qualifications

Financing for All Industries – Not Just Restaurants!

At ROGP Capital, we provide funding solutions for a wide range of industries, not just restaurants.

Over the years, we’ve expanded our approved industry list to support businesses across various sectors. Click below to explore and see how we can help finance your business growth!

Credit Score

Flexible Funding – Even with Less-Than-Perfect Credit!

At ROGP Capital, your credit score won’t hold you back from securing the funding you need. We offer working capital loans with approvals starting at an Equifax credit score of just 551, ensuring that more business owners can access fast, flexible financing to grow and thrive.

Time in Business

Simple Eligibility – Get Approved with Just 30 Days in Business!

At ROGP Capital, we make funding accessible and hassle-free. To qualify, you must own the business, and it must have been open and operating under the same ownership for at least 30 days. If you meet these requirements, you’re already on your way to securing the capital you need!

Annual Sales

Revenue Requirements – Qualify with $17K Monthly Sales!

To secure funding with ROGP Capital, your business must generate at least $17,000 in monthly sales (or $200,000 annually) from both credit card and cash transactions. If your business meets this requirement, you're well on your way to getting the capital you need to grow!

How Can I Use a Bridge Loan?

A Bridge Loan is a smart, short-term funding solution designed for businesses pursuing growth opportunities that promise high returns. It’s ideal for companies needing fast capital while waiting for longer-term financing—like an SBA loan—or while finalizing the sale or refinance of commercial real estate.

Before applying, carefully consider your company’s goals for both immediate and long-term growth. Evaluate seasonal fluctuations and other conventional funding options to ensure a Bridge Loan aligns with your strategy.

Ask yourself:

✅ Am I missing out on growth opportunities because I lack immediate capital?

✅ Does my business plan include high-impact investments in the near term?

✅ What does my short-term cash flow look like, and can I wait for traditional approval?

Businesses without a Bridge Loan might be stable day-to-day but unable to act quickly on lucrative investments—often leaving money on the table while waiting for conventional funding. With a Bridge Loan, you can seize opportunities now without draining your operating cash.

How to Apply for a Bridge Loan

Apply for a Bridge Loan in Minutes – No Impact on Your Credit!

Looking for a bridge loan with guaranteed rates, fixed terms up to 36 months, and affordable payments? Applying is quick and easy! Simply complete our online application—with just a few pre-qualification questions and 5 simple steps, all with no hard credit pull so your credit remains unaffected.

💡 Need personalized guidance? Our expert loan consultants are ready to assist, offering local market knowledge and one-on-one support to help you secure the best funding solution.

Is a Bridge Loan the Right Solution for Your Business?

For restaurants, hotels, and retail businesses, waiting on traditional financing can slow down progress and delay revenue. A Bridge Loan ensures you have immediate access to capital so you can launch, expand, or invest—without bringing in new partners who could reduce your ownership and control.

With a Bridge Loan, you get:

✔ Flexibility & Control – Access funds when you need them, without giving up equity

✔ A Built-In Line of Credit – Withdraw up to five loan drafts over six months

✔ Immediate Financial Security – Keep operations running smoothly while waiting for long-term financing

Instead of delaying business growth, secure the funding you need now and stay in control of your success!

📞 Call us today to explore your bridge loan options!

Why ROGP CAPITAL?

Terms and Conditions

ROGP, LLC operates as an independent third-party originator and servicer of commercial loans in partnership with various national lending institutions throughout the United States (collectively referred to as the “Lender”). This Preliminary Loan Amount has been determined based on initial pre-underwriting standards aligned with the Lender’s guidelines and the information provided by the Merchant. Approval of this amount is contingent upon the accuracy and completeness of the Merchant’s submitted information, as well as any additional findings uncovered by the Lender or servicer during the underwriting process. This includes, but is not limited to, a review of all financial statements, credit history of any guarantors, public records regarding liens, judgments, collections, fraud, bankruptcy, or criminal activity, and the status of the Merchant’s business entity with the relevant state authorities. The final terms and conditions may be adjusted following this comprehensive review. No terms are deemed final or binding until the Merchant has agreed to and executed all required loan documents, which must then be countersigned and formally approved by an authorized officer of the Lender. If the Merchant has not executed a Universal Merchant Credit Application, this Preliminary Loan Amount is provided solely for discussion purposes and does not constitute an offer or commitment to lend.

At ROGP Capital, LLC., we are committed to providing trusted financial solutions that empower you to achieve your goals. Our dedicated team is here to guide you every step of the way, offering personalized lending options that fit your unique needs.

Quick Links

Contact Us

Legal

© ROGP Capital 2024 All Rights Reserved.