Working Capital Loans

Empowering You To Do More!

What is a Working Capital Loan?

A Working Capital Loan is designed to provide fast, flexible funding for small businesses and restaurants to cover everyday operating expenses. Unlike traditional bank loans that require long approval times or merchant cash advances with hidden fees, ROGP Capital’s working capital loans offer:

✨ Quick approvals and funding in days—no long waits

✨ Fixed terms with predictable payments—no surprises

✨ Tax-deductible interest to lower your overall cost

If you need immediate cash flow to keep operations running smoothly and fuel business growth, a Working Capital Loan is the perfect solution to get the funds you need—fast!

📞 Book a Call Today!

Why Choose a Working Capital Loan?

✨True Bank Loan – Unlike merchant cash advances, our financing offers fixed payments that won’t increase with credit card sales.

✨Fast & Easy Approval – Minimal paperwork and funding in less than a week.

✨ Flexible Repayment Terms – Up to 36 months for manageable payments.

✨Renewable Line of Credit – Enjoy 24/7 access to additional funds when needed.

✨Tax-Deductible Interest – Reduce your overall cost of financing.

✨ No Hard Credit Pulls – Apply without affecting your credit score.

✨Flexible Credit Requirements – Less-than-perfect credit won’t hold you back.

📞 Apply today and secure the funding your business needs—fast and hassle-free!

Size Matters!

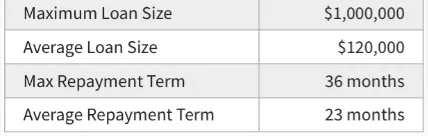

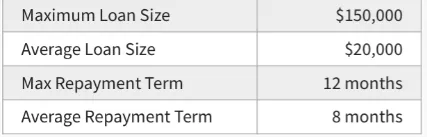

Bigger Loans, Longer Terms, Greater Rewards

Big ideas deserve big funding—something a typical merchant cash advance just can’t deliver. If you’re ready to level up this year, we offer financing designed to fuel your most ambitious projects. Borrow up to $1,000,000 with flexible terms up to 36 months, keeping costs low and growth high. On average, our loan sizes are six times larger and our repayment terms are three times longer than a standard merchant cash advance. That means you get the capital you need to seize real growth opportunities, while longer terms ensure low, manageable payments that protect your cash flow. See how we stack up below:

Average ROGP Capital

Business Loans

Merchant Cash Advance

Minimum Qualifications

Financing for All Industries – Not Just Restaurants!

At ROGP Capital, we provide funding solutions for a wide range of industries, not just restaurants.

Over the years, we’ve expanded our approved industry list to support businesses across various sectors. Click below to explore how we can help finance your business growth!

Credit Score

Flexible Funding – Even with Less-Than-Perfect Credit!

At ROGP Capital, your credit score won’t hold you back from securing the funding you need. We offer working capital loans with approvals starting at an Equifax credit score of just 551, ensuring that more business owners can access fast, flexible financing to grow and thrive.

Time in Business

Simple Eligibility – Get Approved with Just 30 Days in Business!

At ROGP Capital, we make funding accessible and hassle-free. To qualify, you must own the business, and it must have been open and operating under the same ownership for at least 30 days. If you meet these requirements, you’re already on your way to securing the capital you need!

Annual Sales

Revenue Requirements – Qualify with $17K Monthly Sales!

To secure funding with ROGP Capital, your business must generate at least $17,000 in monthly sales (or $200,000 annually) from both credit card and cash transactions. If your business meets this requirement, you're well on your way to getting the capital you need to grow!

How You Can Use Your Working Capital Loan

At ROGP Capital, we understand that small business owners need flexibility when it comes to financing. Whether you’re experiencing strong growth or preparing for unexpected expenses, our working capital loans provide the fast funding you need—without sacrificing equity.

Common Uses for a Working Capital Loan:

✨Upgrade or purchase equipment

✨Stock up on inventory

✨Renovate, remodel, or expand

✨Open a new location

✨Cover franchise fees or obligations

✨Obtain a liquor license

✨Manage seasonal cash flow dips

✨Add catering, delivery, or take-out services

✨Upgrade your POS or technology systems

✨Launch a marketing campaign

✨Buy out a business partner

✨Pay business taxes or consolidate debt

✨Handle unexpected expenses

Why ROGP CAPITAL?

Terms and Conditions

ROGP, LLC operates as an independent third-party originator and servicer of commercial loans in partnership with various national lending institutions throughout the United States (collectively referred to as the “Lender”). This Preliminary Loan Amount has been determined based on initial pre-underwriting standards aligned with the Lender’s guidelines and the information provided by the Merchant. Approval of this amount is contingent upon the accuracy and completeness of the Merchant’s submitted information, as well as any additional findings uncovered by the Lender or servicer during the underwriting process. This includes, but is not limited to, a review of all financial statements, credit history of any guarantors, public records regarding liens, judgments, collections, fraud, bankruptcy, or criminal activity, and the status of the Merchant’s business entity with the relevant state authorities. The final terms and conditions may be adjusted following this comprehensive review. No terms are deemed final or binding until the Merchant has agreed to and executed all required loan documents, which must then be countersigned and formally approved by an authorized officer of the Lender. If the Merchant has not executed a Universal Merchant Credit Application, this Preliminary Loan Amount is provided solely for discussion purposes and does not constitute an offer or commitment to lend.

At ROGP Capital, LLC., we are committed to providing trusted financial solutions that empower you to achieve your goals. Our dedicated team is here to guide you every step of the way, offering personalized lending options that fit your unique needs.

Quick Links

Contact Us

Legal

© ROGP Capital 2024 All Rights Reserved.