Business Revolving Line of Credit

Explore the Ultimate Revolving Line of Credit

Take Control of Your Business Finances – The Ultimate Revolving Line of Credit!

ROGP Capital, together with our trusted lending partners, is thrilled to introduce the Ultimate Business Revolving Line of Credit—specifically designed to solve the #1 challenge business owners face: fast, flexible access to capital without sacrificing cash flow stability. This powerful funding solution offers some of the highest approval amounts in the industry (up to $1,000,000), a fixed term of up to 36 months, and predictable weekly payments. Even better, you have complete freedom to borrow more or pay down your balance as often as you need, with no limits and no early payoff penalties. You control when to draw, how much to draw, and how long to keep your line open—flexibility tailored to your business’s evolving needs. It’s smart funding that keeps you firmly in the driver’s seat.

📞 Apply today and put the power of The Ultimate Revolving Line of Credit to work for your business!

📞 Questions? Book a free consultation or apply today!

✅Explore the Ultimate Revolving Line of Credit — Industry-Leading Benefits

✅Explore the Ultimate Revolving Line of Credit — Industry-Leading Benefits:

✨Revolving credit line approvals up to $1,500,000

✨Flexible term with fixed weekly payments for up to 36 months

✨Enjoy a full revolving period of up to 52 weeks (1 year)

✨Make unlimited draws of $5,000 or more anytime during the revolving period

✨Pay down principal in unlimited amounts of $5,000 or more whenever you choose

✨Each payment and principal paydown instantly restores available credit

✨Finance charges accrue and are collected weekly — no hidden fees

✨No minimum finance charge requirement — pay for what you use

✨No prepayment penalties — pay off or reduce your balance anytime

✨Closing points apply only to cash-out funds — no surprise costs

ADDITIONAL ULTIMATE REVOLVING LINE OF CREDIT FEATURES

Max Approvals

The Ultimate Revolving Line of Credit gives you access to your maximum approval of up to $1,000,000, and you only have to take a minimum initial loan amount of $5,000.

Max Repayment Terms

The Ultimate Revolving Line of Credit also gives you access to the maximum loan amortization term of up to 36 months, resulting in low, fixed weekly payments.

Unlimited Draws & Paydowns

During your revolving period, you have the freedom to take unlimited draws or make unlimited partial principal paydowns of $5,000 or more.

Line Availability

Every regular loan payment you make or partial principal paydown frees up the available funds you can access on your line of credit.

Pay Off Anytime

With The Ultimate Revolving Line of Credit, you’re in control. You can pay off your loan or make partial principal paydowns without penalties, maintenance fees or prepayment fees.

Size Matters!

Bigger Loans, Longer Terms, Greater Rewards

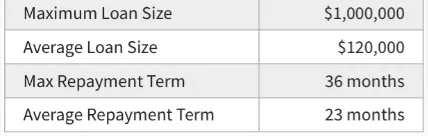

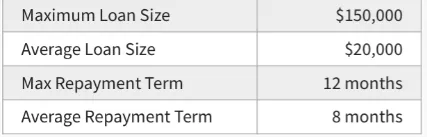

Big ideas deserve big funding—something a typical merchant cash advance just can’t deliver. If you’re ready to level up this year, we offer financing designed to fuel your most ambitious projects. Borrow up to $1,000,000 with flexible terms up to 36 months, keeping costs low and growth high. On average, our loan sizes are six times larger and our repayment terms are three times longer than a standard merchant cash advance. That means you get the capital you need to seize real growth opportunities, while longer terms ensure low, manageable payments that protect your cash flow. See how we stack up below:

Average ROGP Capital

Business Loans

Merchant

Cash Advance

What Is a Business Revolving Line of Credit?

A revolving line of credit works much like a business credit card—but with added flexibility and more favorable terms. You receive a maximum credit limit that you can draw from anytime during the revolving period, which can extend up to one year before requiring a full re-underwriting. To keep your line open and active, a minimum loan balance of $5,000 must be maintained at all times. During this period, you can make unlimited draws or principal paydowns of $5,000 or more, and every weekly payment or paydown instantly frees up more available funds for your next move.

Unlike a credit card, your payments are predictable, with a fixed weekly payment based on the original loan term—up to 36 months. As you repay, those funds become available to use again whenever you need them. This powerful financing tool is popular with savvy small business owners and corporations alike, providing on-demand capital for expansion, new locations, equipment purchases, partner buyouts, or simply as a cash flow safety net.

Use of Funds

At ROGP Capital, we understand today’s dynamic business landscape and the unique challenges faced by industries like restaurants and hospitality. That’s why our revolving line of credit is designed to give small business owners the flexible capital they need to stay ahead. Whether you’re experiencing strong performance and want to seize new growth opportunities—or need a safety net to navigate the unexpected—this line of credit lets you act fast without giving up equity or control. Smart owners know that having a committed, ready-to-use revolving line means they’re prepared for whatever opportunities or challenges come their way.

✨Equipment financing

✨Purchasing inventory in bulk for volume discounts

✨Renovations and remodels

✨ Expansion projects

✨Pay for franchise obligations

✨Take the leap and open another location

✨Obtain a liquor license

✨Operational capital for slow, seasonal periods

✨ Add catering and take-out services

✨ Upgrade your POS / Computer System

✨ Remodel your kitchen for maximum efficiency

✨ Buy out a business partner

✨ Invest in outdoor signage and landscaping

✨ Start a new advertising / marketing campaign

✨ Pay your business taxes

✨ Consolidate and pay off more expensive debt

Minimum Qualifications

Industry Type

We lend to more than just restaurants. Over the years we’ve expanded our list of approved industries.

Click here

to get started.

Credit Score

You don’t need to have perfect credit to qualify for revolving line of credit. Business owners with an Equifax Credit Score of 551 or higher can qualify.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in sales ($200,000 annually) from both credit card and cash.

How to Apply for a Revolving Line of Credit

Ready to secure a revolving line of credit with guaranteed rates, fixed terms, and predictable payments? It’s quick and hassle-free to get started: simply fill out our online pre-qualification form—no hard credit pull, so your credit score stays intact. In just five easy steps, you’ll be on your way to flexible funding that grows with your business. Plus, our experienced local loan consultants understand your market and will guide you every step of the way. Click below to get started today!

Terms and Conditions

ROGP, LLC operates as an independent third-party originator and servicer of commercial loans in partnership with various national lending institutions throughout the United States (collectively referred to as the “Lender”). This Preliminary Loan Amount has been determined based on initial pre-underwriting standards aligned with the Lender’s guidelines and the information provided by the Merchant. Approval of this amount is contingent upon the accuracy and completeness of the Merchant’s submitted information, as well as any additional findings uncovered by the Lender or servicer during the underwriting process. This includes, but is not limited to, a review of all financial statements, credit history of any guarantors, public records regarding liens, judgments, collections, fraud, bankruptcy, or criminal activity, and the status of the Merchant’s business entity with the relevant state authorities. The final terms and conditions may be adjusted following this comprehensive review. No terms are deemed final or binding until the Merchant has agreed to and executed all required loan documents, which must then be countersigned and formally approved by an authorized officer of the Lender. If the Merchant has not executed a Universal Merchant Credit Application, this Preliminary Loan Amount is provided solely for discussion purposes and does not constitute an offer or commitment to lend.

At ROGP Capital, LLC., we are committed to providing trusted financial solutions that empower you to achieve your goals. Our dedicated team is here to guide you every step of the way, offering personalized lending options that fit your unique needs.

Quick Links

Contact Us

Legal

© ROGP Capital 2024 All Rights Reserved.