Interest-Only Flex Pay Loan

PAY ONLY THE INTEREST FOR UP TO A YEAR!

Interest-Only Flex Pay Loan

Pay Only the Interest for Up to a Year!

✨ At ROGP Capital, we know that growing your business shouldn’t drain your cash flow — and our enhanced Interest-Only Flex Pay Loan is designed with that in mind.

✨ Now you can secure funding from $50,000 to $750,000 with low, interest-only payments for up to 12 months, keeping your working capital strong while you expand.

✨ Even better, you’ll have a built-in Line of Credit with unlimited draws for up to a year, giving you the freedom to access funds as you need them.

✨ Once the interest-only period ends, you can either pay down the principal or take advantage of our flexible rollover amortization for up to two more years — giving you the ultimate peace of mind and borrowing power to fuel your business with confidence.

Powerful Upgrades to an Already Exceptional Loan Product

✨ Lower Entry Point: Start your interest-only period with a minimum initial loan amount of just $50,000 — down from $150,000!

✨ Flexible Interest-Only Period: Pay only the interest for up to one full year (52 weeks), with a built-in rollover amortization option for up to an additional two years (104 weeks) to help manage repayments smoothly.

✨ Integrated Line of Credit: Enjoy a revolving line of credit available throughout your entire interest-only term (26, 40, or 52 weeks). The credit line covers the difference between your maximum loan approval and your initial loan amount.

✨ Unlimited Draws: Take unlimited draws of $25,000 or more anytime during your line of credit period, up to your total approved amount.

✨ Flexible Disbursement: Choose to take your initial loan in multiple draws over consecutive business days, making early payoff easier if funds become available sooner. Note: Each Interest-Only Flex Pay Loan or draw will incur minimum finance charges for the full interest-only term if paid off early.

Interest-Only Flex Pay Loan Benefits

Pay Less When It Matters

Use our funds to complete your projects with high return on investment, pay only the interest for the first 12 months, and take advantage of the low payments!

Higher Loan Amounts

You can access loan amounts up to $500,000 if you own a single entity or up to $750,000 with multiple entities.

Our Lowest Rate

Well qualified borrowers with longer time in business, strong and consistent annual sales numbers, and good credit, can qualify for our lowest rate starting at 15%.

The Perfect Safety Net

When the interest-only period has ended, you have the option to pay off the principal, or we’ve built in the perfect safety net rollover amortization up to 2 years.

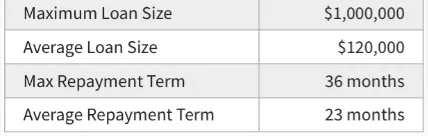

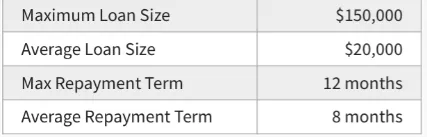

Size Matters!

Bigger Loans, Longer Terms, Greater Rewards

Big ideas deserve big funding—something a typical merchant cash advance just can’t deliver. If you’re ready to level up this year, we offer financing designed to fuel your most ambitious projects. Borrow up to $1,000,000 with flexible terms up to 36 months, keeping costs low and growth high. On average, our loan sizes are six times larger and our repayment terms are three times longer than a standard merchant cash advance. That means you get the capital you need to seize real growth opportunities, while longer terms ensure low, manageable payments that protect your cash flow. See how we stack up below:

Average ROGP Capital

Business Loans

Merchant

Cash Advance

Unique Advantages of Our Interest-Only Flex Pay Loan

✨ Flexible Funding: Access loan amounts from $50,000 to $750,000 to match your business growth needs.

✨ Low, Interest-Only Payments: Enjoy rates starting as low as 15% with up to 12 months of interest-only payments to keep your cash flow strong.

✨ Built-In Line of Credit: Benefit from a line of credit with 24-hour access to unlimited draws of $25,000 or more, giving you the freedom to tap funds as needed.

✨ Safety Net Rollover: When the interest-only period ends, automatically roll into a flexible 18- to 24-month amortization, ensuring smooth repayment.

✨ Fast Funding: From application to approved funds in hand in as little as three business days — so you can act quickly when opportunity knocks.

Terms and Conditions

ROGP, LLC operates as an independent third-party originator and servicer of commercial loans in partnership with various national lending institutions throughout the United States (collectively referred to as the “Lender”). This Preliminary Loan Amount has been determined based on initial pre-underwriting standards aligned with the Lender’s guidelines and the information provided by the Merchant. Approval of this amount is contingent upon the accuracy and completeness of the Merchant’s submitted information, as well as any additional findings uncovered by the Lender or servicer during the underwriting process. This includes, but is not limited to, a review of all financial statements, credit history of any guarantors, public records regarding liens, judgments, collections, fraud, bankruptcy, or criminal activity, and the status of the Merchant’s business entity with the relevant state authorities. The final terms and conditions may be adjusted following this comprehensive review. No terms are deemed final or binding until the Merchant has agreed to and executed all required loan documents, which must then be countersigned and formally approved by an authorized officer of the Lender. If the Merchant has not executed a Universal Merchant Credit Application, this Preliminary Loan Amount is provided solely for discussion purposes and does not constitute an offer or commitment to lend.

At ROGP Capital, LLC., we are committed to providing trusted financial solutions that empower you to achieve your goals. Our dedicated team is here to guide you every step of the way, offering personalized lending options that fit your unique needs.

Quick Links

Contact Us

Legal

© ROGP Capital 2024 All Rights Reserved.